When it comes to managing risk for today’s healthcare organizations, billing compliance and revenue cycle professionals face a common set of challenges.

This white paper explains how combining the efforts of both groups under a unified revenue integrity initiative makes it possible to achieve a more secure financial foundation in the face of constantly changing healthcare regulations and evolving reimbursement models.

Time The Big Idea: What You Need to Know

Today’s healthcare organizations face extreme pressure on multiple fronts. Ramped-up scrutiny from government and private payers is forcing healthcare professionals to be vigilant about maintaining compliance with regulatory requirements. At the same time, the focus on cost controls and the shift from fee-for-service to value-based care has lowered the top line and squeezed profit margins.

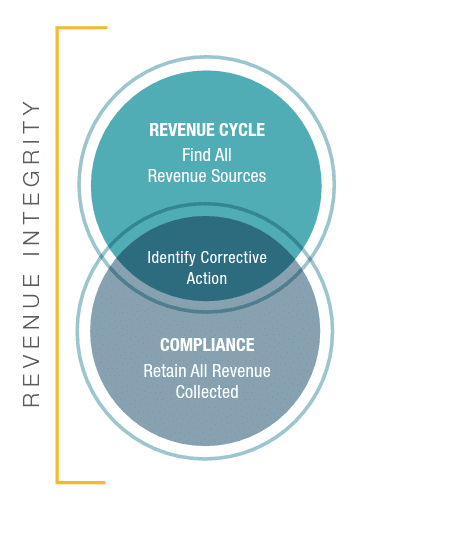

Some forward-thinking organizations are taking on these challenges by combining the efforts of billing compliance departments and revenue cycle teams under a single umbrella called revenue integrity.

Revenue integrity can be defined as getting paid for everything you do – and keeping it.

It’s a holistic approach that breaks down silos within the organization and leverages the combined expertise of both revenue cycle and billing compliance professionals to manage financial risks and create a stronger, more resilient organization.

A strong revenue integrity program marries two surprisingly compatible groups that may not recognize how much their interests overlap. This “unexpected marriage” – formed under the revenue integrity umbrella – aligns organizational resources to pursue common goals such as a more robust revenue stream, decreased compliance risk, and enhanced bottom line performance.

Navigating Continuous Change

Waves of change continue to buffet healthcare organizations, placing their financial well-being in jeopardy. Changing reimbursement models and the launch of new legislation have created an onslaught of mandates, reporting requirements and financial challenges.

Meanwhile, growing oversight challenges from the OIG, CMS and others threaten to undermine hospitals and physician practices that don’t have the resources to adapt. To weather the storm, organizations must focus their limited resources on minimizing billing compliance risks to avoid financial penalties, reimbursement paybacks and tarnished reputations.

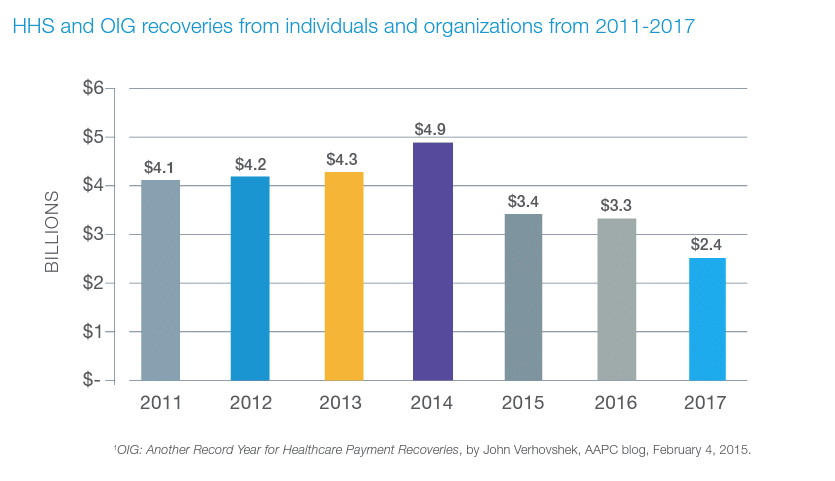

Penalties for non-compliance can place a severe financial strain on healthcare organizations. Despite targeted measures by compliance professionals to minimize monetary penalties, an aggressive OIG continues to hit organizations with billions of dollars in recoveries. In the past seven years, HHS and the OIG have recovered nearly $27 billion from individuals and companies who either attempted to defraud federal health programs or sought payments to which they weren’t entitled.

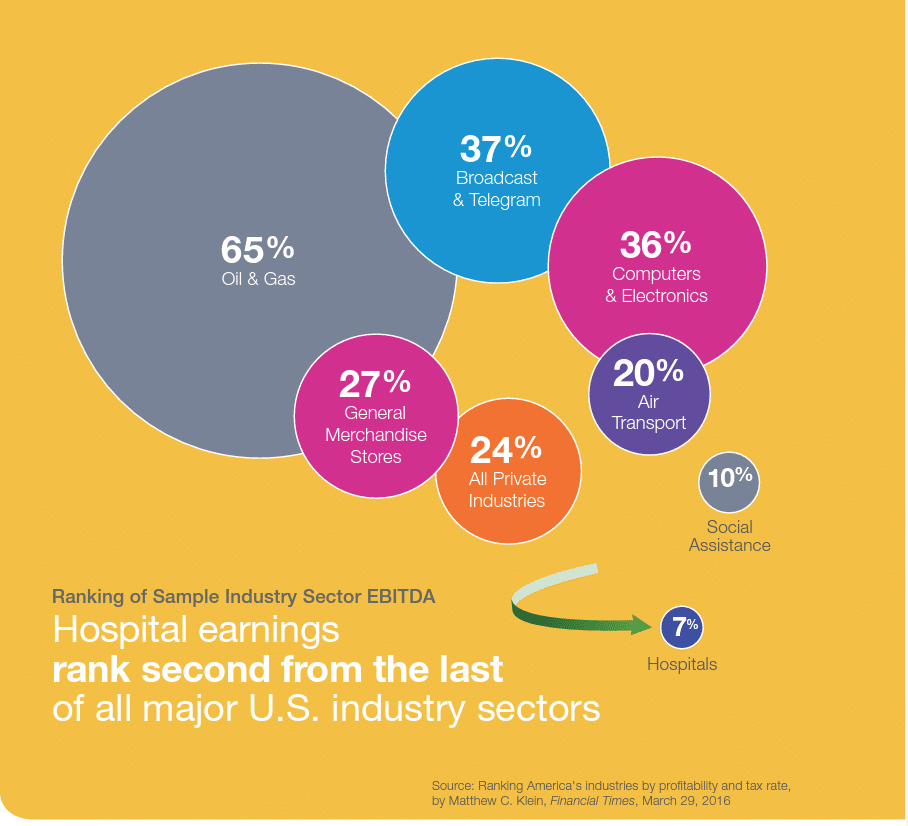

Financial pressures continue to mount as well. In a Bureau of Economic Analysis ranking of EBITDA (earnings before interest, taxes, depreciation and amortization) for 46 industries, hospitals ranked second from the bottom with an EBITDA of just 7% – far below the average of 24% for all industries.

In the current environment, minimizing financial risk is a top priority, whether it’s around preventing compliance violations to avoid financial penalties or correcting revenue cycle issues such as unbilled charges. Effectively managing these risks requires a keen focus on the transaction activity of the organization.

Using the latest analytics tools has proven to be the most effective method of mining this mountain of billing and claims data by giving organizations the ability to identify potential risk areas, determine the root cause and implement corrective action.

In nearly all cases, the data to be analyzed is the same for both compliance and revenue cycle. By combining both teams’ efforts under a revenue integrity initiative, organizations have a better chance of detecting these issues and resolving them much more quickly.

Common Risks for Compliance and Revenue Cycle

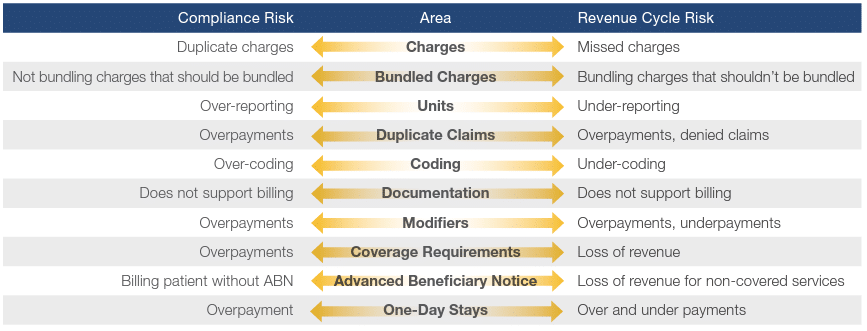

As reliance on data mining and claim analytics becomes more prevalent, it’s becoming increasingly clear that billing compliance and revenue cycle oversight are two sides of the risk equation. Compliance and revenue cycle risks – such as missed charges, over- or under-reported units, duplicate claims, and over- or under-coding – are issues both groups must minimize. Combining forces to address them not only ensures better outcomes, it also reduces the cost of auditing and risk management.

Common Risk Areas and Their Importance to Billing Compliance and Revenue Cycle

Overcoming Data Challenges

Regulatory oversight has become a way of life for healthcare organizations, posing challenges for both billing compliance and revenue cycle teams. Both groups struggle to gain access to the growing amount of data that is scattered across disparate systems. The lack of interoperability and limited integration of EHRs with downstream systems continues to hinder accurate coding and charge capture, creating problems for both billing compliance and revenue cycle teams. Under-coding Does not support billing Overpayments, underpayments Loss of revenue Loss of revenue for non-covered services Over and under payments snapshots of points in time but do little to reveal trends or identify potential risk areas. Manual reviews – with the limited resources normally available to auditing organizations – are unable to produce any meaningful insights.

Even when it’s possible to access the data in the various systems, organizations are finding that simply having data is not enough to help them address the issues they face. There is a growing need for data mining: gleaning meaningful information to identify risks and implement billing compliance and revenue cycle improvements. Effectively managing these risks requires sorting through the mass of available data to find the nuggets of information that can lead to meaningful change.

Finding the relevant data can be difficult within the limits of a traditional risk assessment and audit strategy. For example, scheduled audits and periodic provider reviews offer

Limitations of Traditional Audit Plans

A traditional billing compliance risk assessment and audit strategy normally consists of an annual process based on a compliance work plan. The work is then reviewed regularly and adjusted based on emerging risks and regulatory changes. Sources like the OIG Workplan, PEPPER data, prior audit results, and Recovery Audit Contractor (RAC) activity help to identify potential risk areas. Random reviews of small samples are conducted to validate the level of risk in the organization.

Unfortunately, actual compliance and revenue cycle problems are often missed during these traditional periodic reviews. Reporting, documentation and claims errors from providers who are scheduled for annual audits could go undetected for months until their next scheduled assessment. The result is lack of true insight into the underlying root cause of compliance and revenue cycle risks.

Goals of Risk Management

A key factor in effective risk management is prioritizing your efforts on where the real problems exist, rather than relying on periodic audits that may or may not identify risk.

It’s important to quickly identify issues that are putting your organization at risk so you can initiate corrective action to eliminate them. However, implementing corrective action is only the first step. It’s also essential to validate and verify that the process improvements put in place to mitigate those risks are providing the desired results. This closed-loop process is critical to managing common risk areas for both billing compliance and revenue cycle teams.

Leveraging Analytics to Manage Risk

To achieve their revenue integrity goals, organizations need advanced analytics tools that allow both billing compliance and revenue cycle teams to maintain high levels of accuracy and efficiency. An effective analytics solution provides a common platform that creates transparency so that both groups can efficiently diagnose issues and drive corrective action.

Leveraging analytics helps organizations uncover insights by making it possible to review pattern changes in billing activity to identify the underlying source of issues. It also allows both billing compliance and revenue cycle teams to review key focus areas from the OIG, analyze PEPPER reports, and better target areas that require focused attention and long-term corrective action plans.

An advanced analytics platform helps break down the silos between departments by providing a single source of billing and claims data that both teams can leverage to help meet their goals. A common, proactive approach allows organizations to make the best use of investigative resources and enhance the effectiveness of both departments.

Benefits of an Advanced Analytics Tool

- Enables in-depth analysis of claims and remit data to uncover risks and deliver insights

- Helps automate the investigative process to quickly identify trends, pinpoint anomalies and drive corrective action

- Provides dashboards and alerts that allow you to monitor activity and identify areas of risk in near-real time

- Allows better use of claims and denial data to focus billing compliance audits effectively and identify risks in the revenue cycle process

Optimizing Revenue, Minimizing Risk

The risks that threaten the financial well-being of healthcare organizations are numerous and ever-changing. Both billing compliance and revenue cycle teams are charged with managing these risks, but each group has limited resources with which to carry out that mandate. Marrying the efforts of billing compliance and revenue cycle teams enables organizations to optimize the total available resource pool and thereby increase effectiveness in identifying and solving problems.

By breaking down silos and focusing on a unified revenue integrity program, organizations can make a significant, positive impact on the overall health and financial strength of the institution. And that is the hallmark of a successful marriage.