Revenue cycle management (RCM) staffing shortages have plagued healthcare for years, even as demand for qualified administrative professionals continues to climb – a dire situation exacerbated by pandemic-induced burnout, resignations, and terminations.[i] Nearly half of revenue cycle leaders responding to one survey said their departments are facing severe labor shortages, with 41 percent noting that between 51 and 75 percent of their RCM/billing department roles are currently vacant. [ii]

There doesn’t appear to be any relief on the horizon. The American Hospital Association identifies medical records, billing, and compliance as the fastest-growing healthcare white-collar administrative professions, expected to grow 13% by 2026.[iii] Meanwhile, the U.S. Bureau of Labor Statistics projects that the number of medical record specialists and coders will increase by 9% from 2020 to 2030.[iv]

The worsening shortage coupled with increased demand has, in turn, led to high turnover. According to the Medical Group Management Association, the turnover rate among business operations support staff is nearly 10 percent[v], while over the past five years, hospitals have turned over 100.5 percent of their staff, according to the 2022 NSI National Healthcare Retention & RN Staffing Report.[vi]

The financial impact of RCM staffing shortages is significant, including rising direct costs related to recruitment, onboarding, orientation, retention, overtime pay, and the temporary employees needed to prevent backlogs. Higher labor costs, which increased by 22 percent between 2021 and 2022, also made it harder for hospitals to realize positive margins in 2022.[vii]

All of this comes at a time when hospitals, health systems, and other provider organizations are under immense pressure from payers to ensure that every claim is properly adjudicated. The Centers for Medicare & Medicaid Services (CMS), the Department of Justice (DOJ), and the U.S. Department of Health and Human Services (HHS) Office of Inspector General (OIG) have ramped up audits to reduce improper payments, aided by massive investments in predictive modeling and artificial intelligence (AI) tools to scrutinize claims more closely before adjudication.[viii]

Commercial payers are following in their footsteps, which places a significant burden on the shoulders of shrinking revenue cycle management teams that are already stretched too thin. In one survey, nearly a quarter of hospitals indicated they respond to 500 to 2,000+ external audit-related requests each month from a variety of sources.[ix]

According to the Medical Group Management Association, the turnover rate among business operations support staff is nearly 10 percent, while over the past five years, hospitals have turned over 100.5 percent of their staff, according to the 2022 NSI National Healthcare Retention & RN Staffing Report.

Challenges and Solutions

As the shortage worsens, so too do the short- and long-term impacts for healthcare organizations already under extreme financial pressure due to the pandemic. That, coupled with greater regulatory uncertainty and audit scrutiny, has pushed the need to address RCM staffing challenges to the forefront.

The challenges and barriers created by the shortage that hospitals, health systems, and other healthcare organizations must address are multifaceted. Among these are the cash flow challenges created when there are too few people to perform vital RCM functions such as coding, billing, collections, and denials, leading to rising collection costs, a greater risk of external audits, and delayed reimbursements.[x] Administrative staff are also under extreme pressure to cut costs – often by eliminating positions – and streamline operations, which puts the onus on remaining staff to fill in the gaps, leading to errors, burnout, and turnover.

An estimated 76 percent of healthcare professionals, including RCM teams, are already burned out thanks to heavy workloads, inefficient manual processes including medical auditing, long hours, difficulty maintaining a healthy work-life balance, and limited economic compensation for their time and struggles. That burnout comes with its own costs; an estimated $4.6 billion annually based on lost billings due to reduced hours, physician and staff turnover, and expenses related to finding and hiring replacements.[xi]

Just as the challenges associated with RCM staffing shortage are multi-pronged, so too are the solutions, which must focus on optimizing productivity while retaining and growing staff – all with limited financial resources. These include implementing or making permanent remote work opportunities[xii], as well as increasing training and skill enhancement opportunities to build expertise from within.

Outsourcing some or all RCM responsibilities is something that more than 80 percent of healthcare organizations have also started doing. For many, it provides them with skilled professionals as well as technology and other resources they would not otherwise be able to access.[xiii]

Optimizing front-end revenue cycle processes by modernizing patient access workflows will also help alleviate the burden on remaining staff, including implementing “patient as payer” solutions that can address patient financial responsibility and accelerate collection times.[xiv] Automating workflows is another option, one that is the go-to solution for a growing number of healthcare organizations seeking to address RCM and billing department labor shortages. More than three-quarters of respondents to one Healthcare Financial Management Association survey said they were already using or are in the process of implementing automation – up 12 percent over the previous year.[xv]

Role of Technology in Revenue Cycle Management

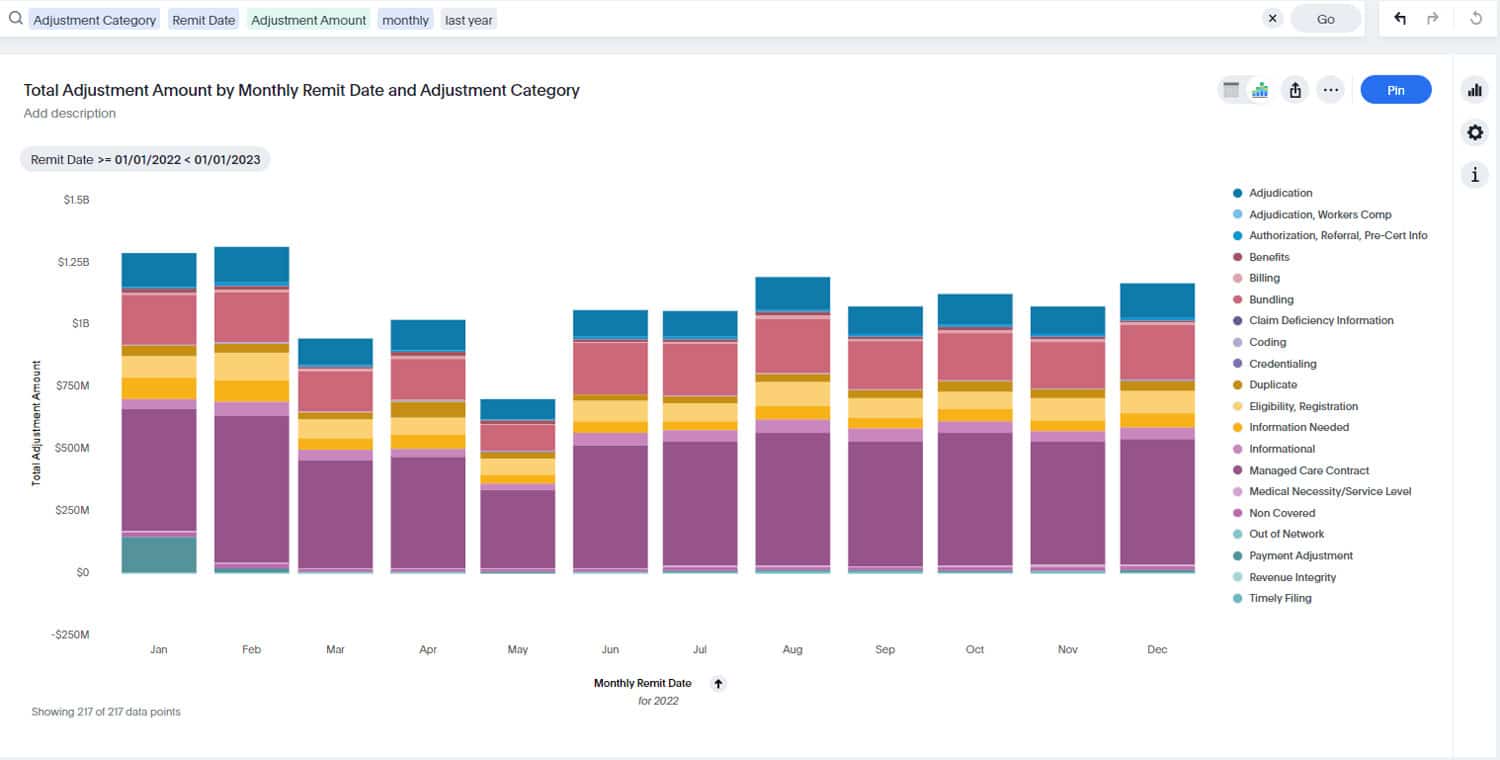

While nothing can replace highly skilled professionals, the reality is that revenue cycle management teams need to leverage technology to automate manual processes and take greater advantage of available data and advanced analytics. This is especially important considering the increase in third-party audits as private insurers follow Medicare’s lead in relying more heavily on prepayment reviews to identify improper reimbursements before they are made to providers.

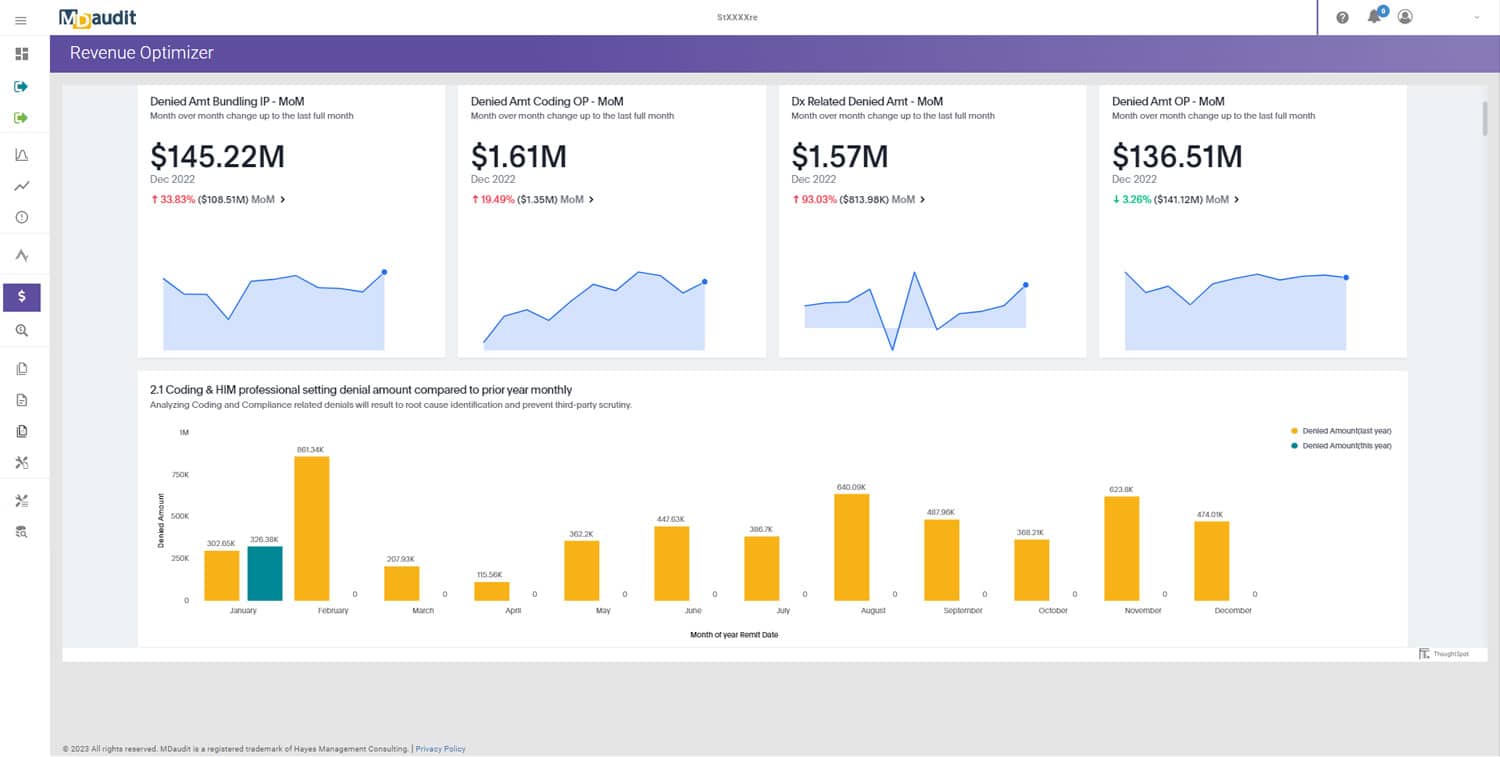

According to research by MDaudit, a 25-year veteran in its space, risk-based audits increased by 28 percent in 2022 while prospective audits increased by 32 percent.[xvi] That is a huge additional burden for RCM teams that are already responding to hundreds of external audit requests each year.

By automating workflows and deploying analytics tools and denial management software, healthcare organizations can take advantage of a hybrid audit strategy made up of prospective and retrospective audits to reduce denials and increase reimbursements. Partnering people and technology also allows for faster audits so errors are caught and corrected earlier in the process – helping hospitals retain as much as 25 percent of their total revenue – and lets auditing staff spend more of their time training and retraining staff on proper billing and coding procedures to optimize revenue cycle management.

The most impactful technology is an integrated cloud-based platform that delivers workflow automation, risk monitoring, and built-in analytics and benchmarking capabilities. By breaking down data silos in departments including coding and RCM, the right platform will also enable a cross-functional approach to leveraging the data needed to achieve revenue integrity.

The benefits of this approach were realized by one Midwestern multispecialty group practice of more than 3,500 physicians in 40 primary care clinics, five specialty care clinics, and several affiliate hospitals. Manual, paper-based audit processes made it impossible for the practice’s compliance department to achieve its goal of auditing all its providers each year.

By deploying MDaudit and its Revenue Optimizer module to automate audit workflows, the practice was able to focus audits on solving the most serious denial-related issues. Each auditor was able to audit two providers per day vs. the weeks it would take previously between preparation time and audit time. As a result, out of $14 million charge claims and 16,590 cases audited, the practice was able to realize $1.9 million in additional revenue, $1.4 million in potential claw backs, and $7.8 million in agreed findings.

Per the associate director for audit compliance education, “Rather than looking at an individual provider, we can determine what the problem is and fix the problem across the board. That not only helps with financials, it ensures our compliance is at a level where our providers aren’t worried about billing-related malpractice and we’re in no danger of ending up on a federal list of practices not complying with the rules.”

The best platforms are also powered by augmented intelligence and expertise in providing proven revenue cycle management services and solutions. This, in turn, drives improved outcomes through actionable analytics and empowers healthcare organizations to increase efficiency, reduce compliance risk, and retain more revenue.

While nothing can replace highly skilled professionals, the reality is that revenue cycle management teams need to leverage technology to automate manual processes and take greater advantage of available data and advanced analytics.

Real-World Impact

The right auditing and analytics technology can also empower progressive healthcare organizations to leverage emerging revenue cycle models and optimize the productivity and capabilities of internal RCM teams. This was the case for one of the country’s largest integrated pediatric health systems and the only U.S.-based children’s health system with two freestanding hospitals and outpatient centers in four states.

The health system deployed an integrated platform after shifting to a financial errors rate model of auditing, which its leadership considered to be a better measure of risk. In addition to the new model, their coding integrity department expanded its annual auditing load to 20 records per provider, in addition to providing consulting expertise to the central business office, front-end billing, and revenue cycle teams.

MDaudit provided advanced functionality to streamline and expand auditing processes while supporting the health system’s new auditing models. The “risk intelligent” auditing software enabled the organization’s billing compliance and revenue integrity professionals to continuously monitor risk, detect anomalies and automate workflows in a single, secure cloud-based platform. It also provided all the necessary tools to minimize billing compliance risks and optimize revenue.

Once the solution was up and running, the coding integrity department saw immediate benefits. Mature and fully integrated audit workflows and automated data ingestion allowed team members to access claims history right from the audit without going into the electronic health record (EHR) to view remits. As a result, within one year of implementation, they had audited $2.5 million in total charges and identified $195,000 in compliance and revenue risk.

“It’s more intuitive, and the solution provides a very clear pathway from start to finish,” said the coding integrity auditor. “There is more information on the page when we are doing our audit, and you can always find your audits easily. You have information about the coder and the supervising physician at your fingertips. That makes a big difference. It’s much easier now that it’s a streamlined process.”

Conclusion

Leveraging advanced AI and analytics technology to automate RCM workflows, streamline processes, and enable prospective and retrospective auditing can overcome many of the challenges associated with the ongoing shortage of skilled professionals. The right platform can help boost productivity, alleviate burnout, and enhance the revenue cycle.

However, truly optimizing RCM departments in the midst of a staffing shortage requires more than just the right technology. It must be complemented with subject matter expertise and cross-department collaboration and communication.

Working together with technology, healthcare organizations can overcome RCM shortages by empowering revenue integrity teams to identify, prioritize, and address systemic denial risks with the most significant financial impact while maximizing limited resources.

_____________

[i] Gooch, K. Vaccination-related employee departures at 55 hospitals, health systems. Becker’s Hospital Review. Feb. 17, 2022.

[ii] Cass, Andrew. Nearly half of RCM departments facing severe labor shortages, report says. Becker’s Hospital Review. June 30, 2022. Available at https://tinyurl.com/j7jfwn4a.

[iii] American Hospital Association. Trendwatch: Hospital and Health System Workforce Strategic Planning. January 2020.

[iv] US Bureau of Labor Statistics. Medical Records and Health Information Specialists. Occupational Outlook Handbook. Visited Feb. 20, 2022.

[v] DailyPay. Health Care Turnover Rates [2021 Update]. Blog. June 14, 2021.

[vi] NSI Nursing Solutions. 2022 NSI National Health Care Retention & RN Staffing Report. March 2022. Available at https://tinyurl.com/2ykj7hpe.

[vii] KaufmanHall. National Hospital Flash Report. Kaufman, Hall and Associates. December 2022. Available at https://www.kaufmanhall.com/sites/default/files/2023-01/KH_NHFR_2022-12.pdf.

[viii] MDaudit. 2022 MDaudit Annual Benchmark Report. November 7, 2022. Available at https://meetings.hayesmanagement.com/report-2022-benchmark-report

[ix] Morse, Susan. Payer payment integrity audits are a financial burden to providers. Healthcare Finance News. Jan. 28, 2020. Available at https://tinyurl.com/56t6rpmd.

[x] Webinar. How Penn Medicine fought revenue cycle staff shortages with efficiency, retention. Becker’s Hospital Review. Jan. 22, 2022. Available at https://tinyurl.com/2p8pn96j.

[xi] McGlone, Jordan. Healthcare Burnout: Admin and Support Staff Are Struggling Too. Patient Calls Blog. Jan. 19, 2022. Available at https://www.patientcalls.com/blog/healthcare-admin-burnout/.

[xii] Melvin Miller. Key Revenue Cycle Trends for 2022 and Beyond. Blog. American Institute of Healthcare Compliance. May 2, 2022. Available at https://aihc-assn.org/key-revenue-cycle-trends-for-2022-and-beyond/.

[xiii] LaPointe, Jacqueline. 3 Strategies for Revenue Cycle Management Optimization. RevCycle Intelligence. July 8, 2021. Available at https://www.revcycleintelligence.com/news/3-strategies-for-revenue-cycle-management-optimization.

[xiv] Staff. Top 5 Trends Impacting Healthcare Revenue Cycle Management. RevCycle Intelligence. March 29, 2021. Available at https://www.revcycleintelligence.com/news/top-5-trends-impacting-healthcare-revenue-cycle-management

[xv] Bailey, Victoria. Hospital Revenue Cycle Automation Adoption Sees 12% Increase. RevCycle Intelligence. Aug. 27, 2021. Available at https://revcycleintelligence.com/news/hospital-revenue-cycle-automation-adoption-sees-12-increase.