While auditors traditionally mitigate risks, they are now being pulled into the revenue cycle continuum and contributing to revenue generation.

The Changing Role of Auditors in Healthcare

The role of auditors in healthcare has been and is evolving significantly due to the increasing complexity of healthcare systems, care delivery regulatory changes, payer policy changes, and the integration of advanced technologies.

Traditionally focused on coding quality and compliance audits to ensure billing risks and overpayments are mitigated, modern auditors now play a crucial role in contributing to generating revenues by identifying systemic sources of underpayments – as well as working denials that fall under their purview to ensure maximum reimbursements – like medical necessity.

Auditors are also integral in ensuring compliance with an ever-growing array of regulations, such as those related to patient privacy under HIPAA and the accuracy of billing practices under the False Claims Act. As healthcare continues to digitize and evolve, auditors are increasingly required to possess a blend of financial acumen, information technology (IT) expertise, and a deep understanding of healthcare laws and standards. This shift not only enhances the integrity and transparency of healthcare operations but also contributes to the overall improvement of patient outcomes.

The Traditional Focus on Mitigating Risks

Traditional healthcare risk management focuses on individual risk examination to protect the assets of the organization. Previously, a heavy focus on identifying and rectifying the reasons for overpayments and ensuring billing was in direct compliance with work plans from the Office of Inspector General (OIG). Staying “squeaky clean” to avoid unnecessary scrutiny has traditionally been the name of the game.

A downfall of this traditional approach is the silo of auditors in the larger revenue cycle continuum. When auditors have a seat at the table and a voice in discussions, they can provide valuable insights into the root causes of revenue leakage, allowing these issues to be identified and resolved.

According to the American Society for Healthcare Risk Management, “With an integrated, enterprise-wide view of risk, the risk manager has a much more strategic position, focusing on opportunities as well as risks.”

Evolution of Auditors’ Responsibilities

The COVID-19 pandemic ushered in a layer of complexity for auditors who began contributing in new ways to support the organization. At the same time, government and commercial payers began incorporating technology to double down on audits, including the use of artificial intelligence (AI) to analyze data. This action ramped up in intensity post-pandemic as the profession of healthcare has struggled to return to normalcy.

This disruption resulted in new challenges with labor and talent shortages impacting every stage of the revenue cycle and operational efficiency organization wide. While traditionally auditors are apt to look at overpayments, now with weak margins, undercoding and revenue leakage must also be evaluated at the auditing level.

Following the hiatus during the pandemic, Medicare and commercial third-party payers have resumed audits in earnest, bringing increased scrutiny and denials. According to MDaudit’s 2023 Annual Benchmark Report, external payer audits quadrupled in 2023 (compared to 2022), making it more difficult for healthcare organizations to respond in a timely manner. These audits are often triggered when payers believe that providers have not provided enough evidence of medical necessity and/or have overutilized particular codes, modifiers, diagnosis codes, etc.

The responsibility of risk mitigation has become two-fold from the traditional method of individual risk assessment. Auditors are essentially stepping into two roles to both mitigate risks and find revenues as well as help fight the new onslaught of external audits.

A United Front: Traditional Workflows are Combining with Revenue-Generating Practices

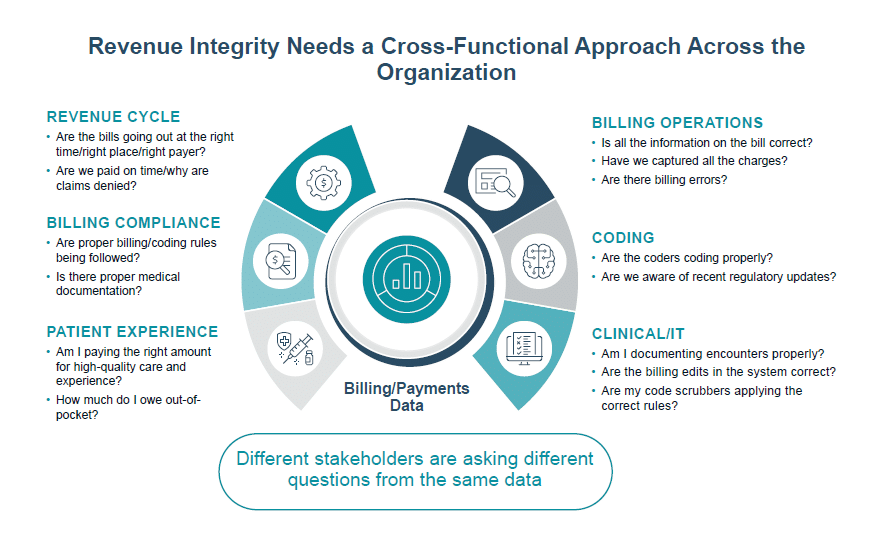

A united front represents the cohesive communication and decision-making that should exist between stakeholders from revenue integrity, revenue cycle, billing compliance, coding, HIM, and others. Every touchpoint of this continuum should have access to the same data insights for mitigating risk and strengthening revenues. When a united front exists, healthcare organizations have proven to be highly successful in staying compliant while still helping pad bottom-line margins.

Stakeholders working from the same data and making collaborative decisions will strengthen the overall value and legitimacy of the organization’s revenue integrity program.

Collaboration between Auditors and Revenue Cycle Teams

What is today’s auditors’ role in the revenue cycle continuum? Recent trends suggest that today’s healthcare auditing professionals are placing a heavy emphasis on:

- Undercoding

- Overcoding

- Revenue Leakage (taking accountability for the denials under auditor purview – medical necessity)

- External Audits

- Having dialogue with providers and coders on how to bill with the highest levels of accuracy and integrity via regular education sessions and CAPs (corrective action plans)

- Alignment and cohesiveness with the revenue cycle

Strategies for Effective Communication and Information Sharing

Improved processes and dialogues between auditors and other facets of the revenue cycle are vital for success—particularly, the relationship between coders and auditors. Despite lots of noise around autonomous coding innovations in the market, coding remains one of the biggest revenue realization opportunities for health systems.

In 2023, based on MDaudit data, 56% of the coders audited failed and 22% of the cases audited were found unsatisfactory. Best practices around coder/auditor collaboration and communication can drastically improve these statistics.

Best Practices for the Auditor and Coder Relationship

- Combine a blend of retrospective and prospective audits of coders

- Engender healthy dialogues via the rebuttal process – let auditors and coders speak freely until claims are coded with the highest level of accuracy and integrity

- Employ analytics for a risk-based vs traditional approach – this will help auditors easily identify the ‘at risk’ coder populace, so targeted and timely education can be done

- Use claims data and remit (denials) data to identify the root cause of denials – specific denial categories and reasons can be directly traced back to coding issues – i.e., medical necessity, possibly DRG downgrades, etc.

- Close the loop with post-audit education

- Don’t silo coders – make them part of the united front

Leveraging Technology in Auditing

Healthcare has entered a new era of technological solutions. SaaS (software as a service) is playing a new role in the auditing processes by identifying the 20 percent of charges that drive 80 percent of denials dollars exposing you to risk and revenue loss. Revenue integrity is being transformed through technological advancements that provide continuous risk monitoring capabilities across the healthcare revenue cycle management continuum. Manual manipulation of data is no longer manageable and effective, but with technology, auditors can use sophisticated AI, analytics, and benchmarking to stay ahead of the curve.

This technology enables auditors to adopt a more productive and efficient risk-based approach. Including the ability to analyze billing and denial data, identifying providers and coders whose practices fall outside normative ranges and contribute to the highest number of denials. Consequently, auditors can focus on high-risk areas, providing targeted education to prevent recurring issues. When this education is implemented, profit margins improve. By leveraging technology, auditors can allocate more time to crucial activities often neglected due to current demands, such as provider education and corrective actions.

Prospective Auditing and Automation

A shift from reactive to proactive auditing strategies requires an in-depth analysis of processes and data that does not traditionally exist in most organizations. With the increased complexity of labor shortages time and resources, organizations are finding it necessary to work smarter, not harder. This is accomplished through the adoption of prospective (aka concurrent) auditing workflows backed by insights provided by data analytics.

Auditing technology now offers auditors data automation that will easily pull randomized samples of provider and coder billing patterns for coding quality reviews – this will eliminate all spreadsheets and time-consuming manual processes. Evaluation and Management (E&M) leveling, and Risk Area Worksheet auditing aides can be tailored to the unique needs of each organization. Additionally, reporting capabilities auto-capture everything done during the audit process so that education sessions and CAPs can be implemented and easily tracked.

Artificial Intelligence: Identifying Coding Anomalies

AI tools are changing the game for auditors, billing compliance, and revenue integrity healthcare professionals. Conversational and generative AI provides robust features to simplify the audit process. For example, MDaudit’s AI Assist allows auditors to ask simple yet very detailed questions about their audit outcomes in plain English and will immediately generate results. Example: “What providers had unsatisfactory audit outcomes over the last 3 months?” – such a question can immediately generate an answer from AI Assist that will outline provider names and scores.

Such solutions can analyze vast amounts of healthcare data identifying patterns, trends, and anomalies related to claim denials and aberrative billing patterns. As healthcare enters a new era of technology solutions, success is largely dependent on augmented intelligence; a subsection of artificial intelligence machine learning developed to enhance human intelligence rather than replace it. People are irreplaceable in the implementation of any AI tool.

Customer Case Study

Main Line Health is a not-for-profit health system with five hospitals, six health centers, 40+ offices, and 2,000+ physicians.

The Challenge

Amid economic challenges, Main Line Health needed tools for minimizing compliance risk and systematizing provider education.

“Every health system today is struggling. We’re struggling. Everybody’s struggling. We have to find whatever we can find. Anywhere we can find it,” says Karen Gallagher, compliance audit manager at Main Line Health.

In an increasingly precarious post-COVID healthcare environment where every dollar counts, healthcare organizations must protect the bottom line by going beyond minimizing compliance risk associated with overcoding. Today, billing compliance departments are being called on to break down silos and identify opportunities for their organizations to maximize revenues in new and creative ways.

The Solution

MDaudit increased audits and made them and provider engagement more meaningful for long-term impact.

In the nine months since utilizing MDaudit in May of 2022, Main Line audited over 8,000 claims, representing a 17% increase in total claims audited and pushing total charges audited up by 20% to $20 million.

Main Line leverages Risk Stratification in the Billing Risks Module of MDaudit to identify their top 10 high billers and top 10 under coders. It has also accelerated the integration of new providers into the auditing program, allowing the compliance department to “get them in and through the system and coding more in accordance with the acuity and complexity of the care that they’re providing, rather than just being a middle lane driver,” says Gallagher.

The Outcomes:

Within nine months of MDaudit utilization, Main Line Health accomplished the following:

- Audited over $20M in gross charges (an increase of 20%)

- Audited over 8K claims (an increase of 17%)

- Reduced undercoded claims by 65.13%

- Reduced overcoded claims by 11%

Summary

Auditors have been left out of the revenue conversation long enough. There’s room at the table for everyone, and auditors offer specific contributions of value that cannot be replaced. Cross-functional workflows and collaboration provide a strong line of defense against revenue leakage. Combine teamwork with technology, and organizations stand a fighting chance against today’s revenue cycle challenges and ever-changing payer policies.