Finding financial success starts by building a carefully planned strategy that balances the requirements of the heavily regulated healthcare industry with resources that allow you to capture all the revenue you have earned. This whitepaper explains the steps to follow to ensure an organization builds a revenue integrity strategy focused on optimizing reimbursement.

Why You Need to Take a Proactive Approach

The financial health of today’s healthcare organizations is dependent on multiple fluid factors: tighter operational margins, shrinking reimbursements, ongoing regulatory changes, and a continued shift away from traditional fee-for-service models to value-based care—just to name a few.

A mid-2020 study from the American Medical Association found that providers, on average, saw a 32% revenue decrease amid the pandemic, and many entered 2021 operating within razor-thin margins. Another report pointed to at least $323.1 billion in financial losses for hospitals and health systems in 2020.

New regulatory mandates coupled with documentation changes associated with telehealth and the Evaluation and Management (E&M) Codes are exacerbating compliance challenges. Recent events also point to an uptick in audit activity. In late 2019, for example, the HHS Office of the Inspector General (OIG) recommended that the Centers for Medicare and Medicaid Services (CMS) direct its contractors to recover $54.4 million in improper payments to acute care hospitals due to incorrectly coded claims.

Amid these converging trends, a proactive approach to financial health is critical to positioning and long-term viability for today’s provider organizations. Strategic planning in healthcare comes in many forms, and revenue cycle should be front and center as a priority. To ensure future success and sustainability, healthcare organizations should consider these seven steps to a healthy financial outlook.

Step 1: Choose a strategic planning model to support internal analysis

Strategic planning is the formal process of setting a healthcare organization’s future course. When considering financial health, this starts with a keen understanding of internal weaknesses and strengths related to revenue cycle. Provider organizations can consider such techniques as a SWOT (Strengths, Weaknesses, Opportunities, and Threats) or PEST (Political, Economic, Social, and Technological) analysis to define direction.

Foundationally, an internal analysis should consider how the following impact revenue cycle:

- Success factors

- Goals and objectives

- Organizational culture

- Core competencies

- Current conditions

- Service or technology portfolios

- Competitive and regulatory pressures and changes

- Functional business models and departmental alignment

Step 2: Identify strategic goals and objectives that support a holistic approach to financial health

While many models exist to support design of a strategic roadmap, implementation strategies should address three key business questions:

- What do we do?

- For whom do we do it?

- How do we excel?

When considering financial health, the answers to these three questions may drive you to take a revenue integrity driven approach.

A progressive revenue integrity model reaches beyond existing revenue cycle processes to focus on mitigation of risk and identify opportunities to increase revenue by avoiding claim denials, thereby increasing first-pass pay rates and reducing the administrative burden of working those claims. This strategy is characterized by a proactive, data-driven approach to claims auditing that streamlines processes and fosters better collaboration between billing, coding, and compliance professionals to identify problems, educate staff and improve overall processes.

Step 3: Address the “people” component of implementation strategies

Traditional revenue cycle management processes are typically characterized by fragmented, siloed functions across billing, compliance, and revenue departments. These outdated approaches fall short of understanding the power of collaboration between clinical documentation, coding, billing, and compliance within a more optimal revenue integrity model.

A better approach addresses the “people problem” first by bringing these groups together and creating a single, transparent view into functions across the entire organization. Cross-functional committees can then work together to identify opportunities for educating staff and implementing better processes when issues are identified.

Consider if you have the right players in your organization to meet your goals. Just 10 years ago, few organizations had a revenue integrity team. As times evolve, so do the needs of your organization. Subsequently, it may be time to reorganize your teams to be more effective and help break down the silos.

Step 4: Design processes that ensure effective oversight and accountability

To meet your strategic goals, a critical component is formalizing the processes needed. Consider if your healthcare organization currently has the processes in place that are needed or if you need to introduce new ones.

For example, a sound revenue integrity strategy marries the strengths of retrospective and prospective auditing. Prospective auditing addresses problems prior to claim submission while retrospective analyzes underlying problems following adjudication. This combination ensures revenue integrity teams can identify the root cause of errors and educate stakeholders to ensure clean, timely claims from the start.

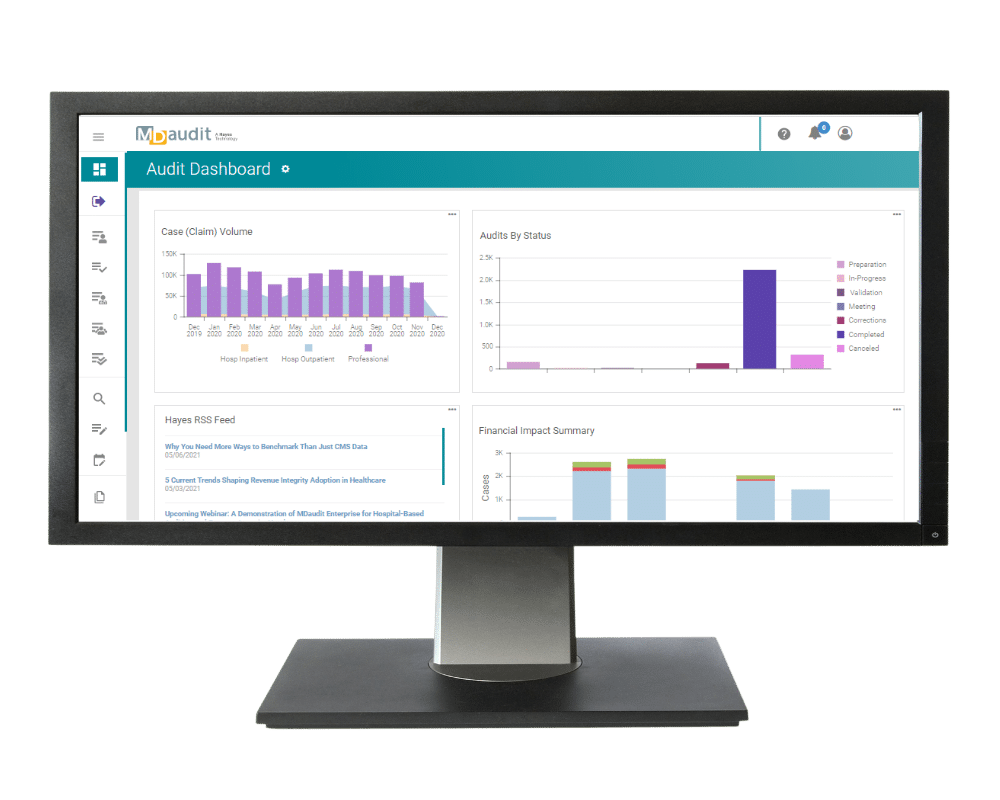

Leveraging technology-enabled processes through MDaudit Enterprise, a cloud based (SaaS) healthcare compliance and revenue integrity platform, the University of Utah Health was able to draw on the power of Augmented Intelligence (AI) capabilities such as natural language search (NLS) and machine learning to support anomaly detection in at-risk claims. This proved especially beneficial within the fluid framework of claims guidance during the COVID-19 pandemic.

Step 5: Take hold of the promise of technological advancement

Revenue integrity processes rely on mountains of data. Resource heavy manual efforts to comb through thousands upon thousands of claims lines often result in limited impact.

Solutions like MDaudit can now offer A.I. techniques, such as natural language processing (NLP) and time series forecasting to enable providers to move closer to real-time monitoring and prescriptive process improvement by tracking such risk areas as case mix index, elective surgery trends and average lag days from denial resubmission to adjudication.

Step 6: Establish metrics for ongoing monitoring and benchmarking

When revenue integrity processes are powered by technology enabled efficiencies, healthcare organizations can free up time to elevate strategies by identifying high-risk areas within the revenue cycle and generating key metrics around process improvement. Key performance indexes are available that reflect industry best practices and should be used by healthcare organizations for benchmarking.

Step 7: Embrace forward-thinking risk-based auditing practices

Regulatory compliance demands and heightened risk place enormous strain on resource-strapped healthcare organizations.

Risk-based auditing—an approach increasingly embraced across provider organizations—allows healthcare organizations to deploy resources around areas of greatest risk. Instead of taking on the rigors of auditing every provider in every area of care, this strategy audits a cross section of providers, zeroing in on identified problem areas. These tactics may focus on specific providers that appear to have different billing trends from their peers or perhaps focus on codes that appear problematic.

A Strategic Approach to Financial Health

Optimal approaches to revenue integrity that ensure compliance with the latest regulatory guidance and capture of all reimbursement opportunities are critical to future success and sustainability for today’s provider organizations. Achieving this level of financial health requires a strategic approach that prioritizes people, processes, and technology.

Healthcare organizations that employ the seven steps outlined in this paper stand to realize a healthy bottom line and competitive advantage going forward.

Learn more about how MDaudit can help ensure confidence in your healthcare organization’s revenue stream. Request a demo today.