As the Omicron variant spreads across the US and the delta variant continues to push COVID-19 cases higher, it’s a grim reminder that the COVID-19 pandemic is far from over. Although 60% of the country is vaccinated with multiple doses and many lessons were learned by the 2020 pandemic cycle, hospitals and health systems are preparing for a rough road ahead. They are bracing for higher utilization, staffing shortfalls, and an increase in demand for COVID-related services leading to greater clinical and financial pressure in the days and months ahead.

Since the advent of the pandemic in 2020, MDaudit has been enabling healthcare organizations to mitigate compliance and revenue risks through our platform with various targeted initiatives. We will continue to provide data-driven insights to healthcare organizations during and after the pandemic.

Recently we performed an analysis of the data from a sample of 50+ large healthcare organizations across the nation using our Revenue Optimizer denials insights module to provide some insights and implications for healthcare organizations relating to the current COVID-19 surge.

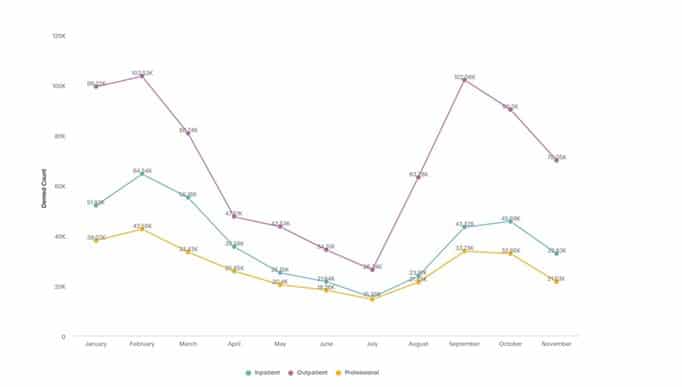

Infections started to surge in August of this year and outpatient utilization will continue to increase in the months ahead.

We see from our analysis of denials data that infections started rising in August after it had bottomed out in July, and the trend peaked around September reaching levels last seen in early spring. The months of October and November were relatively “high” compared to what was seen in late spring and summer of this year. If there is any silver lining from the data, we observed that a majority (approximately 70%) of the cases in the sample are outpatient cases, which emphasizes the efficacy of vaccinations and other therapeutics available to fight the severity of the disease relative to last year. Healthcare organizations will see further pressures on their outpatient utilization related to COVID-19 services in the coming weeks and months. There is a heavy risk of demand outweighing capacity. Organizations must plan for staffing, PPE’s and make critical decisions that impact their other essential non-COVID related outpatient services such as elective surgeries. Compliance organizations need to align their auditing plan and processes to manage this industry trend.

Figure 1 – Sample of 2021 YTD denial volumes trend of COVID-19 confirmed cases by patient type

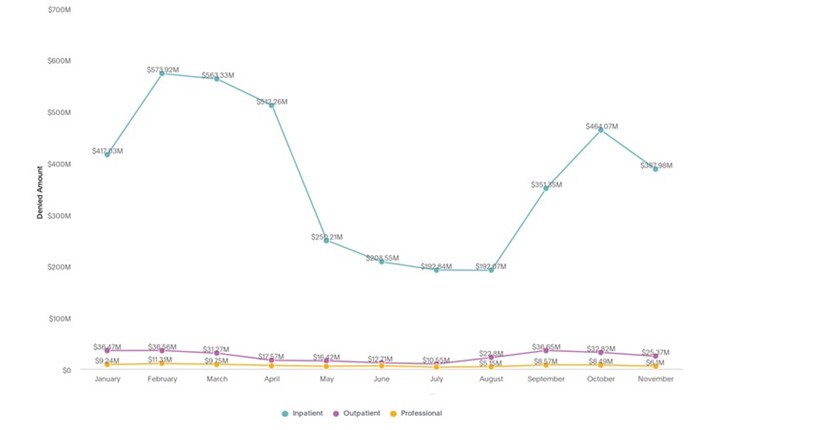

Hospital inpatient billing still present a significant revenue risk in terms of denials.

We had earlier in the year emphasized how healthcare organizations should proactively address complex inpatient charges in terms of billing, compliance, and revenue integrity to mitigate revenue risks. Although the volume of inpatient COVID-19 cases continues to be lower than the outpatient cases in the current surge, the case volumes in this category are 2-3 times the volume seen in late spring and early summer. This has resulted in total denial dollars associated with Inpatient admissions linearly increasing to 2X-3X to what it was in its lowest levels in July.

Since most of the Inpatient COVID-19 cases are complex, requiring multiple days of stays, services, and charges, organizations can mitigate financial risks with proper coding, clinical documentation, proactive auditing, and appropriate billing submission protocols for hospital billing. Many of these charges will continue to attract RAC and other external audits in 2021 and beyond from federal, state, and commercial payers due to the reimbursement dollars at stake.

Figure 2 – 2021 YTD denial amount trends of COVID-19 confirmed cases by patient type

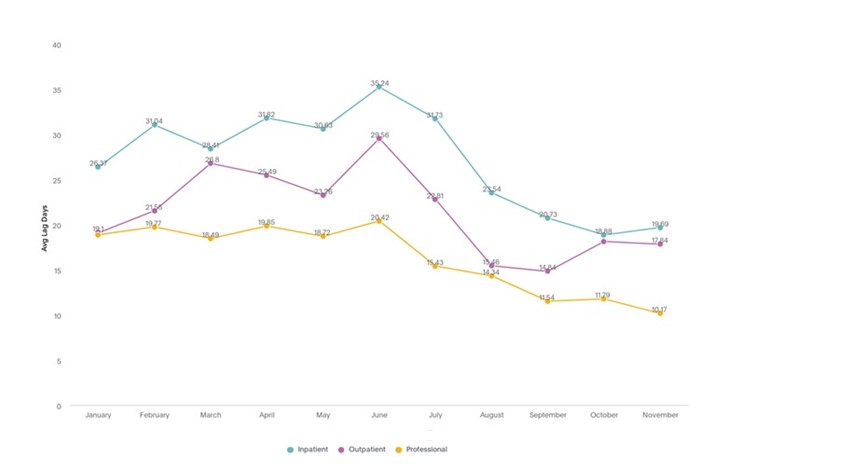

Claim processing times with the payers are still relatively faster compared to the earlier part of the year. Continue to monitor average lag days to payers.

During the 2020 cycle of the pandemic, rules around billing submission and coding were very dynamic and fluid. Hence many organizations delayed the release of claims to payers until they got all the protocols and processes under control. Therefore, claim processing time took longer than usual. 2021 represented a different picture. Average lag days, the time taken to respond by the payer after the initial submission of claim by the provider, have seen incremental improvements for hospital billing since the start of the year to July (from an average of 30+ days to less than 20 days for Inpatient, from an average of 20+ days to less than 15 days for Outpatient).

As we see more surges, we foresee more pressure on the claim processing times from the payer to the provider. To mitigate revenue risks, healthcare organizations should ensure claims (most importantly, hospital claims) are properly billed, coded, and submitted to the payer for payments with appropriate clinical documentation. Once they receive a denial back from the payer, providers should equip themselves with optimal revenue integrity processes and data-driven insights to understand root causes and then follow up in a timely manner to ensure faster payment that impacts their cash flow and revenue.

Figure 3 – 2021 YTD average lag days claim processing trends of COVID-19 confirmed cases by patient type.

As we approach the conclusion of the second year since COVID-19 was discovered in the US, healthcare organizations must remain diligent to keep up with patient care and the financial challenges that an evolving pandemic brings. It isn’t only providers that are struggling. Coders, auditors and revenue integrity teams have been overwhelmed with the volume of cases, the complexity, and the changing coding requirements. A simple look at the charts above help to illustrate how difficult the situation is when the volume of denials double within two months. Revenue flows have been impacted significantly and there is no sign of things getting better in the near term. To keep moving forward, focus on education and corrective action to mitigate future revenue and compliance risk.

To learn more about the insights gleaned from MDaudit Enterprise, download our 2021 Benchmarking and Trends report.