It’s no secret that 2020 pandemic response ushered in a new day for telehealth as demand skyrocketed – a growth trajectory that had long been reticent. The reason? The Centers for Medicare and Medicaid Services (CMS) decided to simplify the rules and regulations related to reimbursement to support ongoing care needs and reduce the spread of COVID-19 within hospitals and clinics.

Many healthcare stakeholders who have touted the promise of telehealth for years saw this as the long-awaited jumpstart needed to support mainstream adoption. While the American Medical Association has had CPT codes available for telehealth billing for years, services rendered this way were extremely limited until recently due to a labyrinth of complicated restrictions, requirements, and reimbursement challenges that varied across state lines. Recent headlines denoting exploding growth—4327% year-over-year in one report—following 2020 suggested that the industry might finally draw on the potential of telehealth to expand access and reduce costs. Yet recent statistics suggest that the industry may be cooling off. And the reasons may point right back to the original culprit: getting paid.

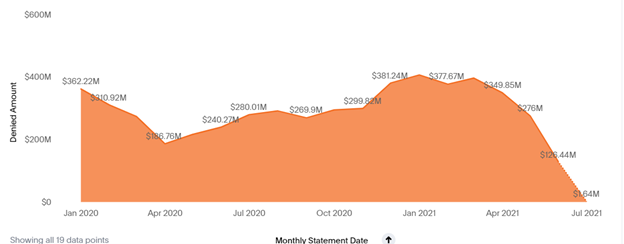

Payers’ good intentions unfortunately created confusion as multiple rule changes forced both third-party carriers and providers to make adjustments. Now providers face the challenge of collecting monies owed, and according to MDaudit cohort data, the outlook for doing so successfully is grim: More than $5B worth of telehealth services from January 2020 to July 2021 have been denied.

Denials are primarily related to the need for additional information and questionable medical necessity, with coding and billing denial reasons also noted. A significant amount of revenue is now at risk at a time when providers are trying to recoup losses from 2020, and billing compliance and coding issues pose a direct threat.

While denial management departments are working tirelessly to appeal and collect the funds, there are additional factors impacting the bottom line. Patient responsibility balances have also increased due to pandemic-related job losses and, in tandem with this hardship, so has bad debt.

With so much at risk, the initial enthusiasm about telehealth could fizzle as providers try to mitigate risk. Notably, many experts believe the emergency rules that streamlined telehealth during the pandemic will ultimately be lifted. This has led industry groups to raise the alarm about a “telehealth cliff,” according to a recent HIMSS20 panel discussion.

Going forward, CMS and other third-party carriers should further simplify regulations for telehealth to ensure that current momentum continues. In the meantime, hospitals and health systems should turn their focus to appealing and adjudicating claims denied during the pandemic.

Prospective auditing that gets out in front of billing/coding errors and clinical documentation issues before resubmission will greatly increase the chances of claim adjudication. In tandem, retrospective auditing can help providers understand the root cause of telehealth denials to inform process improvement.

For many forward-thinking healthcare organizations, solutions like MDaudit Enterprise provide the needed foundation support revenue integrity strategies and protect the bottom line through automation, analytics and artificial intelligence. Technology-enabled auditing processes can improve collaboration between compliance and billing and help providers and patients realize the benefits of telehealth going forward.