In this 7-part series, we will explore the tactics you can employ to build and optimize a revenue integrity team designed to create measurable value for your organization. You can find the other parts of the series here.

If you were asked what 3 things your organization could focus on to improve revenue flow, what would you say? Do you know with certainty your answer would make a difference, or is it just your gut reaction?

By using analytics to understand your current situation, you can say with absolute certainty what changes will make a difference. For example, by using analytics you could identify that 22% of denials are due to lack of authorization or referral. By improving that process, not only will you improve first pass pay rates, you will also reduce the workload on your denials team. You can also calculate the impact of reducing that percentage by half. Reducing denials due to lack of authorization is probably not a tactic you would have said if you relied on your gut, however, data analysis can easily tell you where you how to make an impact.

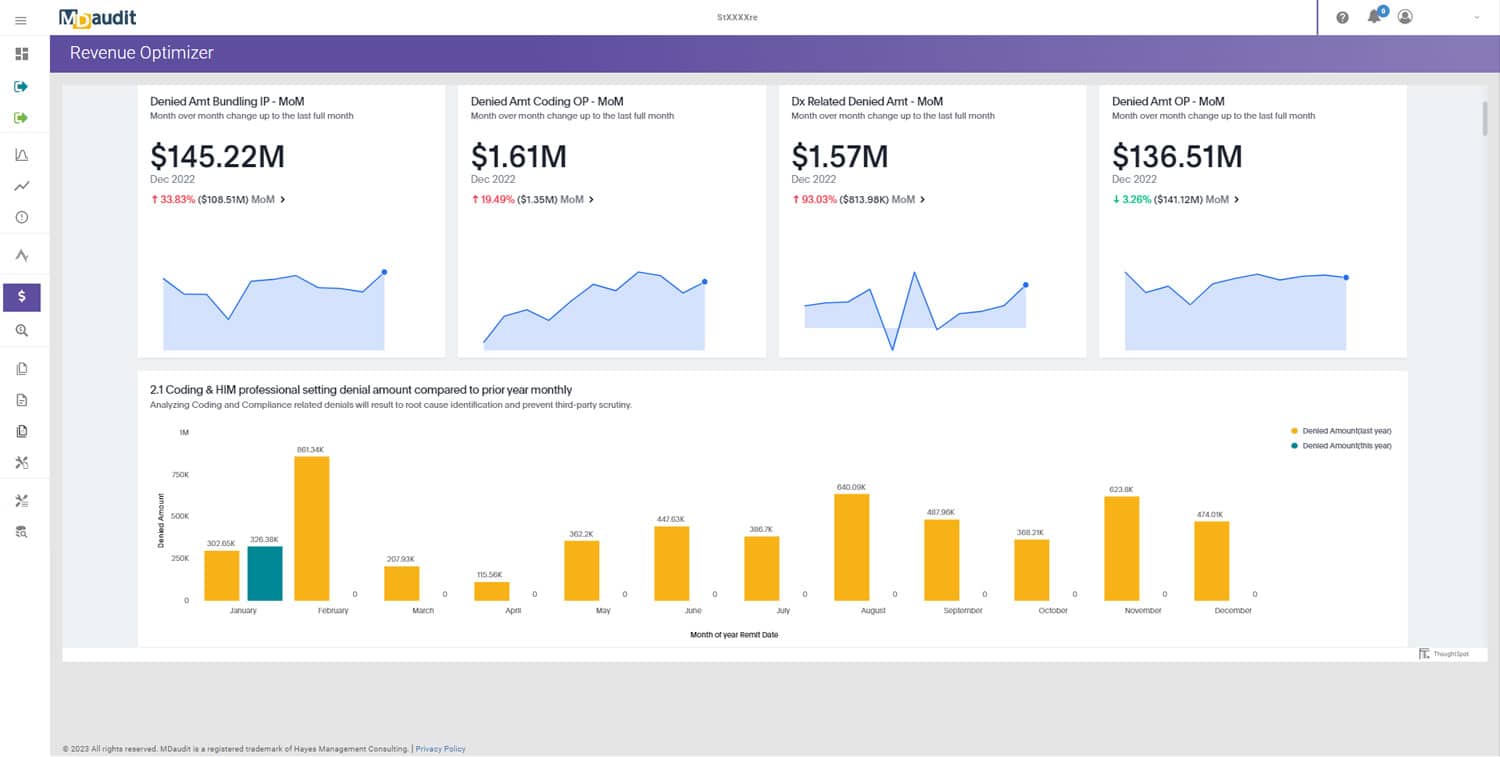

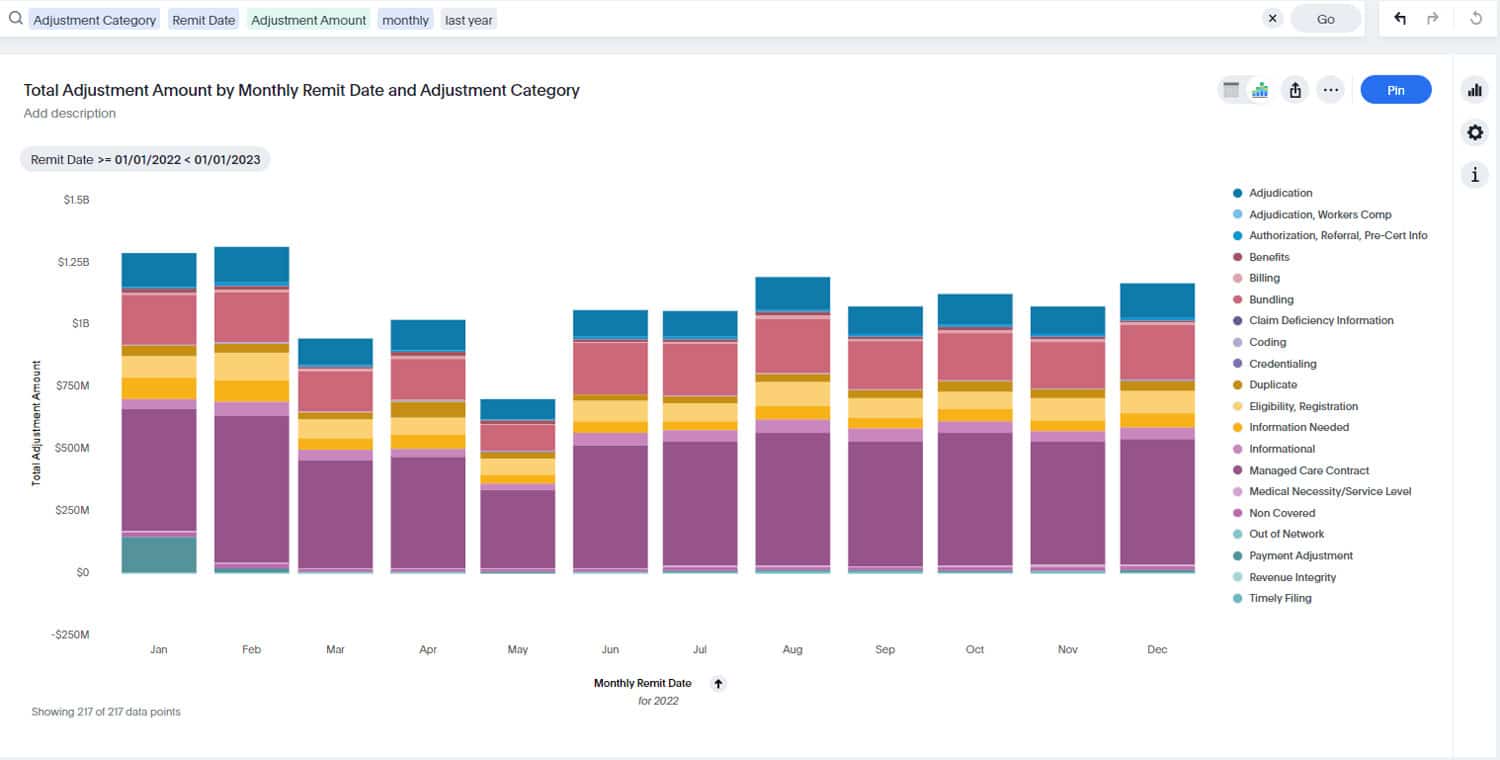

The availability of reliable, comprehensive analytics requires an organization to have a technology solution that can capture and manage the charge and remit data. A solution like MDaudit’s Charge Analyzer and Revenue Optimizer modules makes it easy to identify trends, dive deeper to understand the root cause, and understand what will happen if corrective action is not taken.

What happened?

To get started, you need to identify what happened. Look at your healthcare organization’s results and see if any trends stand out. For example, if 39% of your claims are denied one month, you need to know more. Look at the denial trends and categorize them by a variety of characteristics. Sort by reason, area, payer, or provider.

Why did it happen?

Next, you need to understand why it happened. What is the root cause? Are there any outliers to address? Perhaps you have a coder issue or maybe a documentation problem. By slicing the data further, you can spot trends that aren’t apparent when looking at high-level graphs. For example, an MDaudit customer knew they had an issue and by drilling down into the data, there were able to identify a specific location that was incorrectly using modifier 25. By educating the group, they were able to reduce compliance risk and improve cash flow.

What will happen?

Finally, what will happen if you don’t correct the problem? Perhaps you know that if nothing changes, 33% of your charges will be denied impacting both your revenue stream and also the workload of your staff. If you can identify the top 3 areas that are contributing to the denials, create a corrective action plan that will allow your organization to mitigate the problem and reduce the percentage of denied charges to 25%.

Focus Your Efforts

Going back to the original question, if you were asked what 3 things your organization could focus on to improve revenue flow, what would you say?

With the right technology driving your efforts, you should be able to answer the question with certainty. Imagine what would happen if you could identify and avoid reoccurring errors. You would positively impact compliance risk, revenue flow, and your staff’s workload.

Next up in the series we will discuss establishing goals and driving accountability.