Uncovering overpayments is the latest objective for healthcare organizations across the country. Those charged with protecting revenue must now factor in the considerable financial risks associated with overpayments- an issue gaining more attention from government auditors and payers alike. With recent headlines around scrutiny from the Department of Government Efficiency (DOGE), particularly their collaboration with the Centers for Medicare and Medicaid Services (CMS) payments, there’s never been a better time to mitigate overpayments proactively.

Overpayments have been a hot-button issue in the healthcare industry for a while, with federal and state agencies ramping up investigations into billing irregularities. CMS shared its 2024 improper payment rates. The estimated improper payment rate for Medicare fee-for-service (FFS) was 7.66%, amounting to ~$31.70 billion.

CMS requires providers to report and return overpayments within 60 days of finding them. If they do not, they may face severe penalties under the False Claims Act (FCA).

Avoiding Government Overpayments

All payers, especially government payers, are cracking down on overpayments. The punishment is severe, whether it results from an innocent billing mistake or not.

In fiscal year 2024, the Health and Human Services (HHS) and the Office of Inspector General (OIG) took action. They excluded 3,234 individuals and groups from federal healthcare programs and found over $4 billion in expected recoveries and receivables from HHS-OIG investigations and audits. Experts estimate that overpayments due to Medicare Advantage (MA) plan risk adjustments will rise over $1 trillion in the next decade.

The financially devastating risks of overpayments are pressuring healthcare organizations to adopt a proactive approach to identifying and rectifying overpayments before external auditors step in.

Addressing Billing Risks in 2025

If you haven’t already implemented a proactive approach to billing risks, now is the time. Getting started shouldn’t be daunting.

- Invest in technology, automation, and analytics to drive operational efficiency and stay steps ahead of payer behavior. This type of technology uses augmented intelligence (AI), analytics, and benchmarking to unearth the root cause of under and over-payments so that you can act swiftly and accordingly.

- Align cross-functional teams across billing compliance, coding, clinical documentation improvement (CDI), and revenue integrity. Ensure they all operate from the same data, leveraging it in real time to identify financial risks. This allows for timely corrective action to maximize revenues and mitigate compliance risks.

How Technology Mitigates Overpayment Risks

AI-powered analytics and benchmarking tools can sift through vast amounts of claims data to pinpoint discrepancies, flagging potential overpayments before they become compliance liabilities.

When introducing technology solutions to mitigate billing risk (overpayments and underpayments), consider these key capabilities of a credible overpayment detection technology:

- Automated Claims Review: AI-driven platforms analyze claims data in real time, identifying anomalies and inconsistencies in billing patterns.

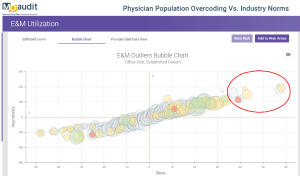

- Benchmarking Against Industry Standards: Comparative analytics help organizations assess reimbursement trends and identify outliers that may indicate overpayments.

- Predictive Analytics: Machine learning models detect patterns that suggest systemic overbilling, enabling proactive and timely corrective action.

- Compliance Auditing: Continuous risk monitoring ensures adherence to evolving regulatory requirements, reducing the risk of government penalties.

Even the most prepared healthcare organizations with the best technology solutions will still receive ADRs from government and commercial payers. The right technology can also provide a second line of defense to help you retain the vast majority of your hard-earned revenues while helping you refund improper or inaccurate billing.

Healthcare organizations can minimize compliance risks and maximize revenue with a single data-driven solution. It is time to take a proactive stance in monitoring underpayments and overpayments. Integrating technology-driven solutions into your revenue integrity strategy can give your organization a fighting chance in the face of increasing scrutiny.